How BPM uses email to re-engage and retain customers

In the past, everything for banks revolved around the product. Communication processes were designed and geared towards providing a service that, more than anything else, could ensure revenues. Then something changed. Now it is vital to cultivate relations with potential and acquired customers on a daily basis, by improving the customer experience and tailoring each campaign to the needs and profile of each recipient.

Today, we’ll be looking at how this is done in practice with an excellent case study, which you can read here in full.

From developing integrations to strategic support, from creating creative concepts to optimizing results.

BPM – part of the Banco BPM Group, Italy’s third largest banking group – decided to work on building engagement and loyalty among its users by creating campaigns that were unbound by specific commercial offers, but focused instead on stimulating interaction and loyalty. To do this, a preliminary step was necessary: greater profiling of the contacts in the database.

Objectives and Strategy

Reward customers and build loyalty: These were BPM’s Goals, along with the need to monitor disused and inactive email addresses in order to boost its open and click-through rates in its subsequent campaigns. With MailUp, BPM therefore decided to develop a targeted email campaign, with the following goals:

- Collect data to diversify future mailings

- Retain customers with targeted action, beyond commercial approaches

- Identify and re-engage inactive contacts, increasing interaction.

BPM determined that birthdays were the best time in the customer lifecycle to make inroads with the customer. Its strategy involved sending a Happy Birthday email with the option to select a gift after filling out a form.

Here are the four phases of the campaign:

- The Happy Birthday email is sent, which contains a clear call to action that sends recipients to a self-profiling form created using MailUp’s BEE editor.

- The data entered by each customer in the self-profiling form is collected and the gift is selected based on their own interest.

- A triggered confirmation email is sent once the gift has been chosen.

- Clusters are created following a segmentation of the database, which is updated with the new data collected.

Results

BPM’s results could be seen right away, showing performance higher than industry averages for Banking & Finance (see them all in the case history). These positive results also reflected the decrease in the churn rate (the percentage of customers who abandon a service compared to the total number of active customers).

While in terms of database segmentation and profiling, the channel proved essential in integrating the analytical information from email marketing together with the information on the customer’s banking behavior: whenever necessary, BPM can develop models to create profiled communications based on each customer’s individual characteristics.

Best Practices

1. Focus on the customer experience

It is not enough to have a great commercial offer, be competitive and know how to communicate effectively. To stay in tune with customers, banks have to stay on top of all touch points (points of contact) with their users. This is because the customer journey does not end when a banking service or product is purchased, but it extends both before and after.

That’s why it’s crucial for banks to know how to map the customer journey correctly by identifying the touch points (both physical and digital) wherever it comes into contact with users, and by structuring the best communication strategy for each of them.

How to keep the thread of the customer journey together? Marketing automation is the keyword – the technology that makes it possible to automatically reach the customer with the right communication at every level of the customer lifecycle, making the most of every touch point and stage in the customer relationship. We’ll talk about this shortly.

2. Collect new data on recipients through self-profiling forms

Information is power. Marketers in the Banking & Finance sector need in-depth and up-to-date information to meet the customers’ needs and expectations. How to obtain more information on the email recipients in a legal and transparent way? One excellent method is self-profiling forms.

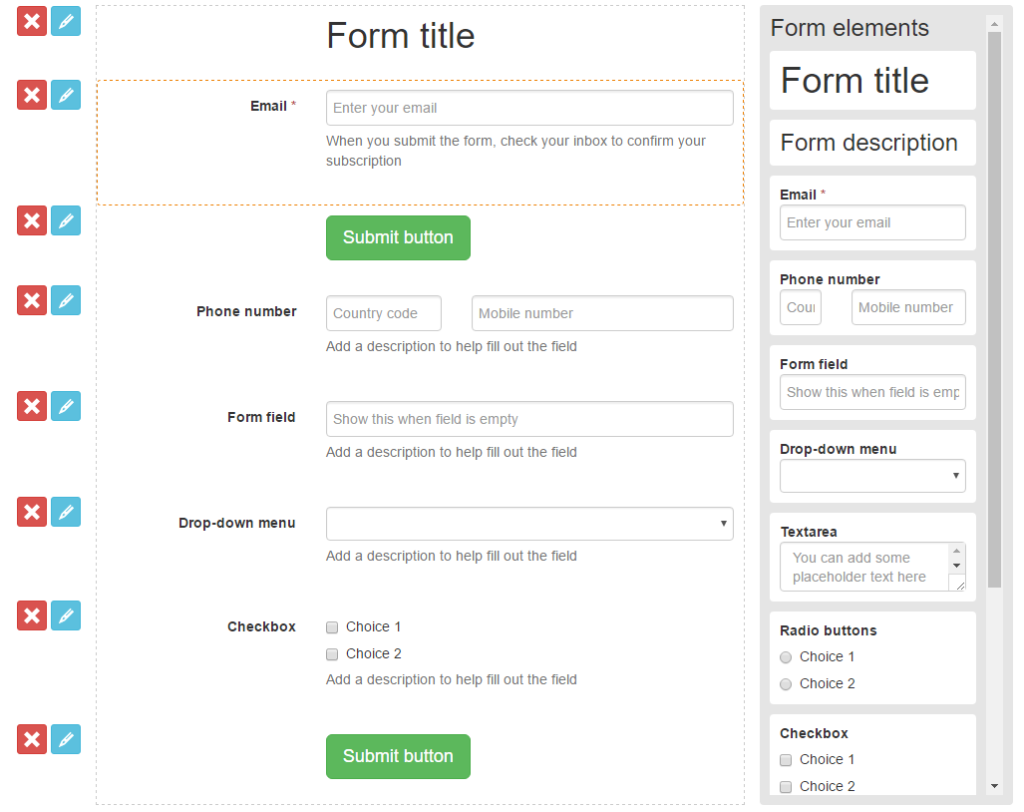

These forms let you ask recipients targeted questions and receive equally precise responses to obtain an increasingly refined profile. You don’t need to be a web designer or even familiar with HTML: the MailUp platform has an integrated drag & drop editor that you can use to create a self-profiling form in just a few clicks.

3. Automate your mailings

The concept of Marketing Automation includes cross-channeling and personalization, which are crucial in a sector like banking & finance where transactional and service communications are no less important than promotional ones.

There are concrete reasons behind adopting Marketing Automation systems: triggered messages are timely, immediate, personalized and extremely relevant to the recipient. Boosting the effectiveness has direct results in terms of opening and clicks rates, which are higher than non-automatic communications. A boost in performance for the full benefit of income.

Once you’ve collected the data from your customers, it’s then time to segment your database and create automated campaigns based on this data, as BPM did with their Happy Birthday email.

To learn more about these topics, read the case study.